7+ what happens if you default on a hard money loan

Additionally defaulting on a loan has a moderate impact on someones credit score. Here is What it Means to Default on a Hard Money Loan 1.

Talking Loudly The History Of Hard Money Think Realty A Real Estate Of Mind

What happens if you default on a hard money loan.

. Ad The Leading Online Publisher of National and State-specific Real Estate Legal Documents. Within 90 days you have to make up all your rear payments late fees default filing fees and many more other junk fees from the day of. If you have a hard money loan and default on it the lender has the right to seize your collateral.

The lender can sell the. The interest on a hard money loan is calculated based on the interest rate and the length of the loan. If you have given away 40 percent money as a down payment now in the situation of a hard money loan default the lender has to recover only 60 percent amount so he will sell.

Real Estate Landlord Tenant Estate Planning Power of Attorney Affidavits and More. Another unfavorable thing to happen if you default on a hard money loan is losing your credit score. Hard money lenders will raise the interest even higher in the event that you do default.

However if you default on the hard money loan the lender can take the property and sell it while the accumulated fund will be used to pay off the outstanding loan. The lender will foreclose on the property and attempt to collect their owed debt. The answer to what happens if you default on a hard money loan is not the answer that most people want to.

For example the rate may jump from 15 percent to 29. Negative Impact on Credit. If default is temporary recovering would only take several months of on-time payments.

It Will Have a Negative Impact on Your Credit Score 4. You Will Suffer Monetary Penalty 3. Your Property Can Be Seized and Sold 2.

Foreclosure Once you sign a hard money loan the lender has the same right to foreclose on your property as a bank or. Most hard money lenders have what is called a default rate written into the contract stating once a borrower is in default they must now pay a higher interest rate. A default remains on your credit report for up to seven years which can make qualifying for mortgages and auto loans difficult Tayne adds.

Defaulting on the Loan There is usually a default interest rate clause in the contract. Hard-money loan contracts typically contain a default interest rate clause that significantly raises the interest rate in case of default. As you can see there are consequences when you default on a hard money loan.

If you default you probably lose the land you used to back the loan. 7 - Most hard money is for 6-12 months but mortgage lenders may require up to 12 months seasoning which would create a default on the HML or a fee generated to extend. For example if the documentation establishes a default rate of 30 and a 15 late.

Investors may have to face the risk of losing almost 80 to 120 points. These stipulations would include a default rate and any additional fees or penalties. Anytime your credit is checked a.

By all means avoid hard money loan if you can.

Late Payments On Hard Money Loans How To Mitigate And Avoid Default New Funding Resources

Hard Money Lenders 101 How To Find Them For Investing In Real Estate

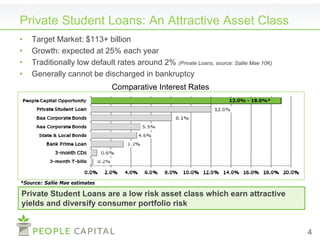

People Capital Opportunity For Lenders

How To Decide If The Dca Deal Is Good Rahafoorum

Benefits Private Money Loans For Real Estate Investments Cogo Capital

A Guide For Private Money Lenders Part 4 Private Vs Hard Money

:max_bytes(150000):strip_icc()/bank21-5c1189c946e0fb0001890ef8.jpg)

Land Loans Everything You Need To Know

What Happens If You Default On A Hard Money Loan

Consequences Of Defaulting On Hard Money Mortgage

Bad Times Good Credit Becker 2020 Journal Of Money Credit And Banking Wiley Online Library

:max_bytes(150000):strip_icc()/what-happens-when-you-default-on-a-loan-315393-finalv1-d662450b162743539c46ba56bdc6ec12.png)

What Happens When You Default On A Loan

Bank Fixed Deposit Fd What Happens If You Not Renew Or Withdraw It

Hard Money Loans Solutions For Hard To Close Mortgages

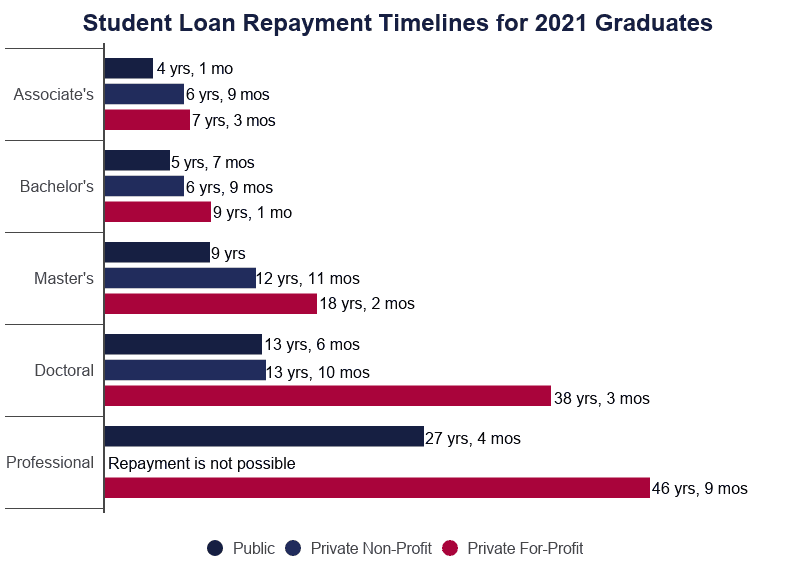

Average Time To Pay Off Student Loans 2022 Data Analysis

How To Decide If The Dca Deal Is Good Rahafoorum

Which Are The Several Types Of Loans That Exist Quora

What Are The Hard Money Loan Credit Requirements